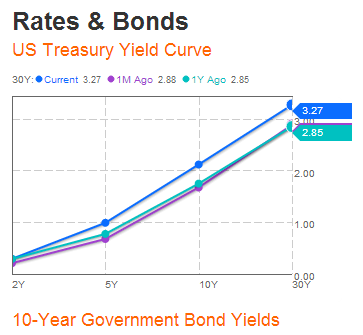

"The bullish case for equities now seems to hinge on the new paradigm thinking that profitability will stay historically high while the Fed keeps bond yields low well into a recovery."

"Maybe this shouldn’t be surprising, given the weight central bankers have put on wealth effects to lift their domestic economies, and, once again, the Federal Reserve has thrown itself behind the bull case. A paper earlier this month by Fernando Duarte and Carlo Rosa of the New York Fed, “Are Stocks Cheap? A Review of the Evidence,” came out with a pretty unequivocal “yes.” Yes, they are cheap.

The Fed researchers look at 29 economic models that estimate the equity risk premium–the expected excess return equities deliver over safe bonds. The average risk premium at the end of December was 5.4%, about as high as it’s ever been since the early 1960s. The only two previous periods when the risk premium was this high were back at the end of 1974 and just before the market hit its post-crisis low in 2009."

Reversion to the Mean is a nasty thing:

Now why would profit margins fall to more normal i.e. (6% long term average)?

Unemployment is high and commodity prices are low and productivity is at all-time highs, the main inputs towards profitability are all favorable towards continuing high profits!

Maybe not:

Fewer people are working, they have left the labor force, retired, live with parents, on the street or have gone into an underground economy:

Yet positions are harder to fill.

Companies have squeezed workers to become more productive and have lean labor forces but they are not prepared for any kind of recovery. Who will they hire? The long-term unemployed? the retired? The homeless?

Rosie makes the argument that there is a shortage of skilled labor and that the price for those workers is going to rise, surprising the Federal Reserve, which still looks at historical data from a world that no longer exists. And he says this segment of the labor market is going to be large enough to create wage-push inflation."

"The crucial change that has taken place over the past decade or so is that wages in low-cost countries have soared. According to the International Labour Organisation, real wages in Asia between 2000 and 2008 rose by 7.1-7.8% a year. Pay for senior management in several emerging markets, such as China, Turkey and Brazil, now either matches or exceeds pay in America and Europe, according to a recent study by the Hay Group, a consulting firm. Pay in advanced economies, on the other hand, rose by just 0.5% to 0.9% a year between 2000 and 2008, says the McKinsey Global Institute. In manufacturing, the financial crisis actually reduced pay: real wages in American manufacturing have declined by 2.2% since 2005.

By contrast, pay and benefits for the average Chinese factory worker rose by 10% a year between 2000 and 2005 and speeded up to 19% a year between 2005 and 2010, according to BCG. The Chinese government has set a target for annual increases in the minimum wage of 13% until 2015. Strikes are becoming more frequent, and when they happen, says one executive, the government often tells the plant manager to meet workers’ demands immediately. Following labour unrest, wages at some factories have gone up steeply. Honda, a Japanese carmaker, gave its Chinese workers a 47% pay rise after strikes in 2010. Foxconn Technology Group, a subsidiary of Hon Hai Precision Industries, a Taiwanese firm that does a lot of manufacturing for Apple and other big technology firms, doubled pay at its factory complex in Shenzhen after a series of suicides. Its labour troubles are still continuing."

Japan has shouldered the weight of a global beggar-thy-neighbor currency battle and trade rebalancing since 2009 with a stronger currency and resulting trade deficit:

Until recently when Abe said, enough and quickly undid years of a strengthening Yen: