I've exited short term bonds SHY (1- 3yr) and some medium term CIU and SHY.

Fed will raise rates before it makes any significant move in reducing QE and/or unloading its balance sheet.

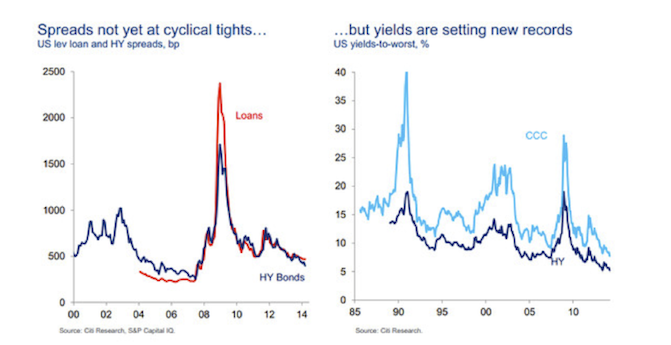

Now it looks like it's time to exit leveraged loans EFR and high yield bonds HYG too.

http://www.ft.com/cms/s/0/f9992ce2-e11e-11e3-b59f-00144feabdc0.html#ixzz32TdpEY6P

The search for yield is creating a dangerous environment for investors, with less call

Financial markets are reaching a tipping point and typically that means most financial asset prices will decline.

Increasingly it seems developed countries will get closer to balanced budgets, tax offshore havens to do this, in coordination.

In short term I like treasuries 7yr+ and cash. i like my house, real assets.

it's worth considering the possibility of a crash, brief deflation, followed by high inflation shortly thereafter. in essence that's my portfolio 7yr+ treasury will appreciate in a crash as will optionality of cash and trade weighted FX value of USDs. Then a quick shift to equities and assets that do well in an inflationary period. Inflation is such a vague word however. Not sure if i'm a realist or an optimist or a fool but we may see a very tight labor market in the US in coming years.

That global company profit margin reversion to the mean from 12% to 6% in addition to the transfer of wealth from an aging generation will mean, a lot, lot of money to spend.

What will do well? Labor. you can't print labor, you can't import it, there will be less of it. What do workers get paid in dollars. What will everyone want when SHTF, cash, the optionality of cash is increasing rapidly.

Many that have left the workforce will not return. Those that will, will take years to retrain.

Thursday, May 22, 2014

Retail Store Space Closures 2005 - 2014

Does this look like a strong recovery? I know we shop at Amazon and online more but, this is a slowdown in spending.

Subscribe to:

Comments (Atom)